A Guide to Japan’s National Health Insurance

Hey there, health-conscious friends in Japan! Japan is known not only for its rich culture but also for its impressive healthcare system.

Japan's healthcare system is renowned for its accessibility and quality of care. In this article, we'll provide a comprehensive guide to understanding Japan's NHI, covering eligibility, benefits, and the role of local governments in managing the system. Japan's healthcare system is a model of universal coverage, providing health insurance to all residents, regardless of nationality, employment status, or income. This comprehensive guide explores the intricacies of Japanese health insurance, the various types, benefits, and costs involved in the system, and how to access and use these services effectively.

Japan's Healthcare System at a Glance

Types of Japanese Health Insurance

1. National Health Insurance (国民健康保険 - Kokumin Kenkō Hoken)

This is a government-run health insurance program for people who are not covered by employer-based health insurance. This includes self-employed people, students, and retirees. National Health Insurance caters to individuals who are not covered by employer-based health insurance, such as self-employed individuals, students, and retirees:

- Coverage: While coverage may be similar to employer-based insurance, NHI may have varying premium rates and co-payment structures.

- Funding: The program is funded by a combination of contributions from enrollees and government subsidies.

2. Employer-Based Health Insurance (会社健康保険 - Kaisha Kenkō Hoken)

This is the most common type of health insurance in Japan. It is provided by employers to their employees and their dependents. Employer-based health insurance is the cornerstone of Japan's healthcare system, encompassing the majority of the working population.

- Coverage: Provided by employers to their employees and their dependents, employer-based health insurance offers comprehensive coverage, including doctor visits, hospital stays, prescription drugs, dental care, and much more.

- Funding: Employers and employees both contribute to the premiums, ensuring a shared financial responsibility.

3. Health Insurance for Individuals Aged 75 and Over (後期高齢者医療保険 - Kōki Kōreisō Iryō Hoken)

This is a special health insurance program for people aged 75 and over. It is funded by a combination of premiums paid by enrollees, employer-based health insurance, and NHI.

This specialized program addresses the healthcare needs of Japan's elderly population:

- Coverage: It provides specific coverage for those aged 75 and older, with a focus on medical services relevant to this age group.

- Funding: Premiums paid by enrollees, contributions from employer-based health insurance, and NHI help fund this insurance.

Understanding Japan's National Health Insurance (NHI)

The Importance and Eligibility of National Health Insurance

All residents of Japan (anyone who permanently resides in Japan for three months or more) are legally required to enroll in at least one health insurance program. Japan's National Health Insurance is a system that makes healthcare affordable and accessible for all, from citizens to residents. Without it, medical costs could become a real burden and create inequalities in care. Thanks to this system, everyone gets the care they need without breaking the bank. It's like your healthcare safety net in Japan!

Co-payment for Doctor Visits and Hospital Stays (自己負担金 - Jibun Futan Kin)

The co-payment is a financial contribution made by the patient during medical visits or hospitalization. It represents the portion of the medical expenses that the enrollee is responsible for covering. Contributions are based on income, with both employers and employees sharing the burden. Premiums are generally affordable, ensuring broad access to healthcare services. Part-time workers' premiums are often lower, making it an attractive option for those in non-traditional employment.

The co-payment rate varies depending on the type of insurance and the age of the enrollee, with certain services like preventive care potentially having reduced or waived co-payments.

Click here for more details about the copayment calculation!

Out-of-Pocket Limit (高額療養費制度 - Kōgaku Ryōyō Hi Seido)

The out-of-pocket limit is a safeguard that caps the maximum amount an enrollee is required to pay out of pocket in a given period, typically per month.

While Japanese health insurance is generally affordable, out-of-pocket costs exist, primarily in the form of co-payments for medical services. These limits protect enrollees from catastrophic medical expenses, ensuring that no one faces insurmountable healthcare costs.

Fortunately, the existence of out-of-pocket limits ensures that these expenses are capped, protecting enrollees from excessive financial burdens. The out-of-pocket limit varies based on the type of insurance, ensuring it aligns with the overall affordability of the program.

- For employer-based health insurance, the out-of-pocket limit is set at 90,000 yen (about $720 USD) per month.

- For National Health Insurance, the limit is slightly higher at 110,000 yen (about $880 USD) per month.

Benefits of Japan's National Health Insurance

Japan's NHI covers a wide range of medical services, including hospital stays, doctor visits, surgeries, and prescription medications. It also extends to preventive care, such as vaccinations and health screenings.

1. Doctor Visits

Routine check-ups, consultations, and treatments with healthcare providers are fully covered, allowing residents to maintain their health and address medical concerns promptly.

2. Hospital Stays

Coverage includes inpatient care, surgeries, and treatments, ensuring that individuals receive necessary medical attention when facing more significant health issues.

3. Prescription Drugs

The cost of prescription medications is subsidized, making essential medications affordable and accessible for all enrollees.

4. Dental Care

Dental services are included in the insurance coverage, promoting oral health and addressing dental issues as part of comprehensive healthcare.

5. Eye Care

Vision care, eye examinations, and treatments are covered, ensuring enrollees can maintain good eyesight and address eye-related conditions.

6. Preventive Care

Preventative measures such as vaccinations, screenings, and health education are an integral part of the healthcare system, promoting overall well-being and early disease detection.

7. Mental Health Care

Japanese health insurance provides support for mental health services and treatments, addressing a vital aspect of overall well-being.

8. Long-Term Care

The system also offers coverage for long-term care services, including care in nursing homes or assisted living facilities, ensuring that elderly and disabled individuals receive appropriate care and support.

How to Get Japan's National Health Insurance

Step 1: Register Your Residence Before you can apply for Japanese National Health Insurance, you need to ensure that you are properly registered as a resident at your local municipal office (city or ward office). This is an essential first step, as NHI eligibility is linked to your residential status in Japan.

Step 2: Visit Your Local Municipal Office Once you are officially registered as a resident, visit your local municipal office. You'll find specific NHI departments within these offices. The staff will guide you through the application process, and they can provide you with the necessary forms and information.

Step 3: Fill Out the Application Forms You'll be given application forms to complete. These forms will require basic personal information, such as your name, address, date of birth, and the names of family members who will be covered under the same insurance policy. Make sure to complete the forms accurately, as any errors could cause delays.

Step 4: Submit Required Documents Along with the application forms, you will need to provide certain documents to support your application. The exact requirements may vary by municipality, but common documents include:

- Your residence card or alien registration card.

- Proof of your previous year's income (tax certificates or income statements).

- Other identification documents, such as your passport and visa.

It's important to check with your local municipal office to confirm the specific documentation needed for your application.

Step 5: Premium Calculation and Payment The amount you pay for Japanese NHI premiums is calculated based on your previous year's income. Your municipal office will determine your premium amount, and you'll receive regular bills for payment. Premiums can usually be paid at convenience stores, through bank transfer, or other designated payment methods.

Step 6: Receive Your NHI Certificate Once your application has been processed and your premium payments are up-to-date, you will receive your NHI certificate in the mail. This certificate serves as proof of your enrollment in the NHI system and provides you with access to healthcare services in Japan.

Step 7: Accessing Healthcare Services With your NHI certificate in hand, you can now visit medical facilities in Japan for healthcare services. When you receive medical treatment, you will generally be responsible for covering 30% of the costs, while the remaining 70% is covered by the NHI system.

Step 8: Keep Your Information Updated It's important to regularly update your income information with your local municipal office, as changes in your financial situation can affect your NHI premium amount. Failure to pay premiums can result in penalties and the suspension of your NHI coverage.

Conclusion

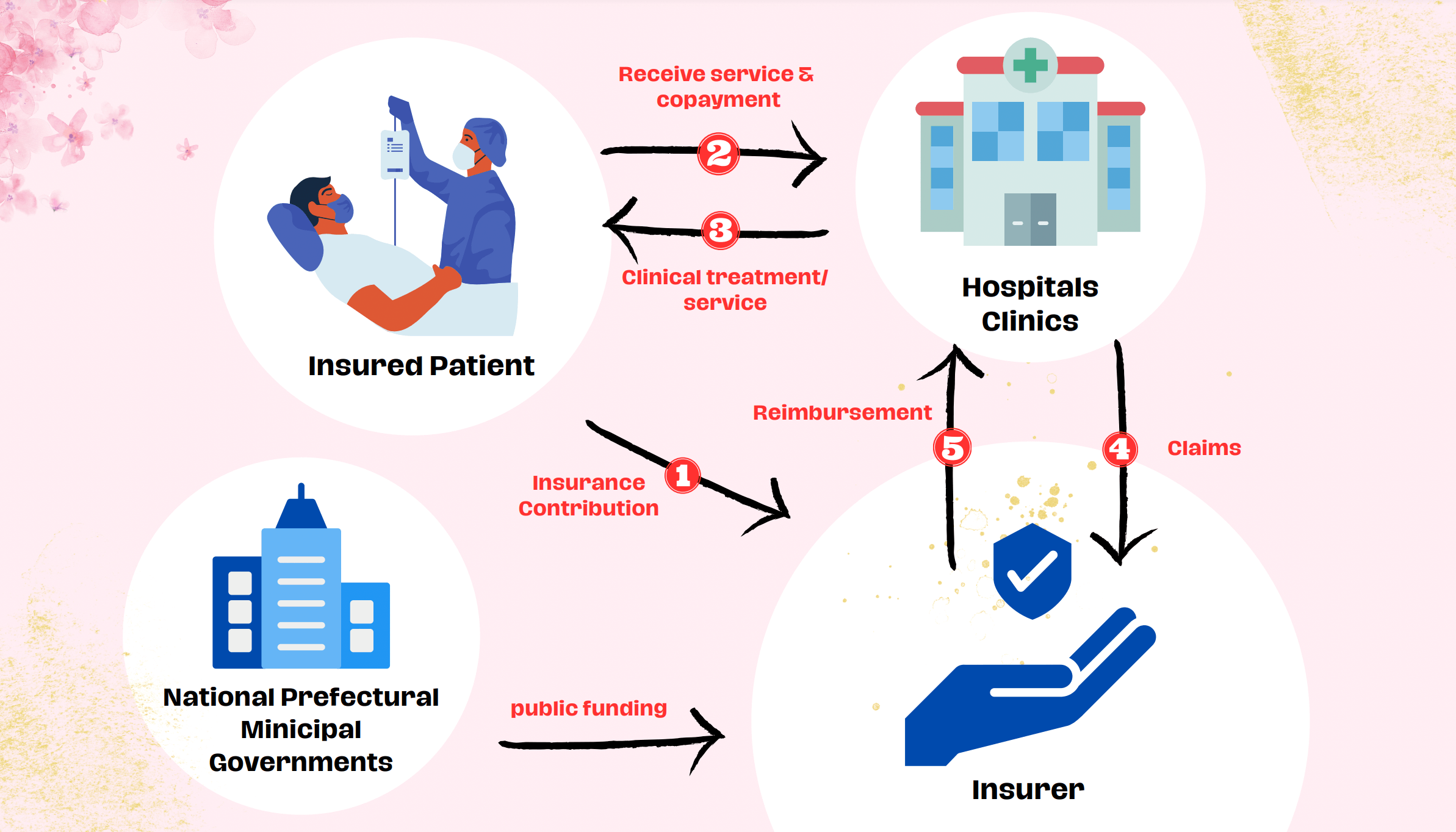

Japanese national health insurance is a universal healthcare system that provides health insurance coverage to all residents of Japan. The system is funded by a combination of premiums paid by employees, employers, and the government.

NHI covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, dental care, eye care, preventive care, mental health care, and long-term care.

The cost of Japanese health insurance is very affordable. And there are out-of-pocket limits in place to protect enrollees from catastrophic costs.

To use Japanese health insurance, you must first enroll in one of the three types of insurance programs. Once you are enrolled, you will receive a health insurance card. When you visit a doctor or hospital, you must show your health insurance card. The doctor or hospital will then submit your claim to your health insurance company. Your health insurance company will then pay the doctor or hospital directly. You will only be responsible for paying the co-payment.

The Japanese National Health Insurance system is more than just a healthcare program; it's a testament to Japan's commitment to health for all. It's accessible, comprehensive, and designed to keep everyone's well-being in mind, regardless of their background. With a unique blend of financial support, inclusivity, and quality healthcare services, it's a system that truly cares for its people. So, if you're planning to visit or stay in Japan, you can rest assured that your health is in good hands.

Stay healthy, my friends!

Frequently Asked Questions about Japanese National Health Insurance

1. How does the Japanese National Health Insurance system compare to other countries?

The Japanese National Health Insurance (NHI) system, known as "Kokumin Kenko Hoken," is a universal healthcare system in Japan. It offers healthcare coverage to all Japanese residents, regardless of their age or health condition. Compared to other countries, Japan's healthcare system is often praised for its accessibility, high quality of care, and relatively low cost.

Some key differences between the Japanese NHI system and healthcare systems in other countries include:

- The Japanese NHI system is primarily funded through premiums paid by individuals and local taxes, making it a predominantly public system.

- Japan has a fee-for-service model, where patients can choose their healthcare providers, and the government regulates the fees.

- The NHI system in Japan covers a wide range of medical services, including hospitalization, outpatient care, and prescription drugs.

- Cost-sharing is relatively low in Japan, with patients typically paying only 30% of their medical expenses, while the government covers the rest.

2. Can foreigners living in Japan enroll in the National Health Insurance system?

Yes, foreigners living in Japan are generally required to enroll in the National Health Insurance (NHI) system. If you are a resident in Japan for more than three months, you are obligated to enroll in the NHI or an employer-provided health insurance plan. This ensures that all residents have access to healthcare services. Enrolling in the NHI system is typically done through your local municipal office, and the premiums are based on your income.

3. What are the key benefits of Japanese National Health Insurance?

The Japanese National Health Insurance (NHI) system offers several key benefits, including:

- Universal coverage: All residents, including foreigners, have access to healthcare services.

- Comprehensive coverage: The NHI system covers a wide range of medical services, including hospitalization, outpatient care, and prescription drugs.

- Low cost-sharing: Patients typically pay only 30% of their medical expenses, making healthcare relatively affordable.

- High-quality care: Japan is known for its high-quality healthcare services and medical facilities.

4. How are premiums calculated for Japanese National Health Insurance?

Premiums for Japanese National Health Insurance are calculated based on your previous year's income. The specific formula and rates can vary from one municipality to another, so it's best to consult your local municipal office for precise details. In general, the premium is a percentage of your income, and there is usually a minimum and maximum limit to the premium amount. Additionally, family members are often covered under a single premium, so the total cost is influenced by the family's income.

It's important to update your income information regularly, as changes in your financial situation can affect your premium amount. Failure to pay NHI premiums can result in penalties and suspension of coverage.

English Teaching Part-Time Job

We provide training, observations, and feedback for new teachers. We will help you to become an effective teacher!